When it comes to value investing, the name “Warren Buffett” surely comes to mind. In The Warren Buffett Way, author Robert Hagstrom provides an insightful account of the legendary investor’s investment strategy. Hagstrom distilled the key principles known as the “12 Immutable Tenets of a Business” which forms the core of Buffett’s investment philosophy.

As much as it is a financial book, it is also a book about Buffett himself. It explores Buffett’s professional life. Including how his investment approach was shaped by his mentors, Graham and Fisher. Lined with anecdotes, Buffett’s investment approach is inextricably linked to humanity. His views about management, working with people, understanding your “circle of competence”, can be applied beyond the world of finance.

This book is relatively easy to read because it is not charged with financial jargons. At a certain point, I found some of the examples illustrating the 12 Tenets rather repetitive. This may be because I am already following him and his investments in Berkshire Hathaway through other articles and books.

I strongly recommend this book as a starting read for any budding value investors, or those who want to tap into the wisdom of the Oracle of Omaha.

These are the 12 principles discussed in the book:

BMFV Compass

Personally, I have categorised these 12 principles into a compass framework, with 4 major categories: (1) Business, (2) Management, (3) Financial, and (4) Valuation.

Business

(1) Simple and Understandable Business

Investors must be convinced that the business they are purchasing will do well over time. It comes from defining your “circle of competence”, a field or industry you are familiar with.

For instance, F&B industries are relatively simple and easy to understand compared to banks and insurance companies. Understanding a company means having knowledge of how the company generates its revenue, what are the cost drivers, cash flow, pricing flexibility, and the industry competitors, amongst others.

“Invest within your “circle of competence. It’s not how big the circle is that counts, it’s how well you define the parameters.” – Warren Buffett

(2) Consistent Operating History

Has the company demonstrated consistent results selling the same type of product year after year? Does the company fundamentally changes direction due to previous unsuccessful plans?

Also, avoid businesses that are solving difficult problems. Investors are often mesmerised by the idea of what tomorrow can bring, such that they ignore today’s business reality. As Buffett says, “turnarounds seldom turn”. Instead, focus on businesses with a steady track record of profitability as it is a reliable indicator of good future results.

(3) Favourable Long-term Prospects

Does the company have a moat (i.e a long-term competitive advantage)?

Franchise vs Commodity Businesses

According to Buffett, the economic world is divided into a small group of franchises and a larger group of commodity businesses. Most of the commodity businesses are not worth purchasing.

A franchise is a company whose product or service (1) is needed or desired, (2) has no close substitute, and (3) is not regulated.

Individually and collectively, these create a moat, or a clear advantage over its competitors.

Franchise Businesses

For instance, Apple is a franchise. Apple products have a strong demand (evidently, the long queues outside Apple stores during new iPhone releases). There is no close substitute to Apple products, strong brand loyalty, and the industry is not regulated.

As a franchise, they are able to charge a premium over competitors. People will still want to buy the latest iPhone, no matter how much the price increases.

Pricing flexibility is one of the key features of a franchise. The ability to command higher prices allows the franchise to earn above-average returns on invested capital.

Commodity Businesses

On the other hand, commodity businesses generally offer low-returns and are “prime candidates for profit trouble”. Commodity businesses offer products that are basically the same as their competitors, and they are easily substitutable. Think, natural resources – oil and gas, gold, silver. Thus, they can only compete on price, which means profit margins will be easily eroded.

The only way for a commodity business to be profitable is to become the low-cost provider or when supply is tight (which is extremely hard to predict).

Key Learning Points: Choose companies with a consistent operating history and favourable prospects. This helps you focus on companies which are relatively predictable, so you can get a sense of how well they will do in future.

Similarly, by concentrating on companies which are simple and understandable, within your “circle of competence”, would allow you to better predict the future impact of the business.

Management

Evaluating the management is difficult because human beings are more complex than numbers. However, the words and actions of the management are telltale signs of the company’s eventual financial performance. If you analyse them closely, you will find clues to help you determine the future of the company long before it is reflected in the news and financial reports.

(4) Rational

Buffett emphasises that capital allocation is the most important job of management. Managers must be rational in their decisions and allocate capital efficiently. This ensures that greater shareholder value is generated.

If the extra earnings are reinvested, and the company can produce an above-average return on equity (ROE). Then logically, the company should retain all its earnings and reinvest them for growth.

When a company generates average or below-average investment returns, and has extra cash, the management has 3 options: (1) Ignore the problem and reinvest internally, (2) Acquire other companies or (3) Return excess capital to shareholders.

(1) Ignore the problem and reinvest internally: In this case, managers are trying to improve the company’s returns through organic growth. They are convinced that with their managerial abilities, they can improve the company’s profitability. Shareholders also become mesmerised by their earnings forecasts.

However, if a company continually ignores this problem of average or below-average returns, the company’s cash pile and stock price will decline. A company with poor economic returns, tons of cash, and a low stock price will attract corporate raiders. Activists are likely to take over the business, which signals the end of their management tenure. To protect themselves, executives often choose option 2 instead: buying other companies for growth.

(2) Acquire other companies: Buffett is skeptical of companies that need to buy growth through acquisitions. It often comes at an overvalued price. Moreover, managing and integrating a new business is not easy and mistakes could be costly to shareholders.

(3) Return excess capital to shareholders: According to Buffett, this is the most responsible decision managers should make, if the company has a growing cash pile that cannot be reinvested at above-average rates.

Assuming the cost of capital is 5% and management is unable to cross this hurdle rate by reinvesting capital. Then, rightfully, managers should return the excess capital to shareholders.

Returning money to shareholders comes in 2 forms: increasing dividends or share buybacks.

Increasing dividends: With cash dividends, shareholders have the opportunity to look elsewhere for higher returns (i.e. above 5%). On the surface, people view increasing dividends as a sign that the company is doing well. However, this is only if investors are certain that they can get higher returns compared to if the excess capital is reinvested in the company.

Share buybacks: Management is repurchasing the company’s shares, which reduces the number of shares outstanding. This increases the earnings per share (EPS) and shareholder value.

(5) Candour

“In evaluating people, you look for three qualities: integrity, intelligence, and energy. If you don’t have the first, the other two will kill you.” – Warren Buffett

Is the management candid with the shareholders and employees?

Go through past annual reports (AR) and CEO letters to shareholders, and find out:

- Does the management only step out and praise the company during good times, but hide and does not disclose key information during bad times?

- Does the management deliver what they promise? Compare what the management says about future strategies from past AR, to the current results. How much of those strategies were realised? Actions speak louder than words.

(6) Resist institutional imperative

Buffett looks for honest and straightforward managers who have their interests aligned with the shareholders.

Some important questions and red flags to take note of:

- Are the CEOs overly remunerated? Are the stock options and compensation schemes tied to their performance?

- Unintelligible footnotes. If you can’t understand them, don’t assume it’s your shortcoming; the management is likely hiding something they don’t want you to know.

- Be suspicious of companies that trumpet earnings projections and growth expectations. No one can be certain of the future, and any CEO who claims to do so is not worthy of your trust.

Key Learning Points: A good management is rational, exercises logic in capital allocation and returns excess capital to shareholders. Having integrity and being candid with shareholders are important values managers should have.

Financial

(7) Return on Equity (ROE) not Earnings per Share (EPS)

Analysts like to measure a company’s performance using EPS. However, Buffett considers EPS a smokescreen. It does not reflect the true picture, since most companies retain a part of the previous year’s earnings to increase their equity base.

Instead, the return on equity (ROE) is a far more useful tool to analyse a company’s performance.

Return on Equity = Net income / Shareholder’s equity

Adjustments:

- All marketable securities should be valued at cost, not at market value

- Exclude all capital gains, losses and extraordinary items which may affect operating earnings

- Ensure there is little or no significant debt (because companies can take on debt to increase their ROE)

(8) Owner’s Earnings

Undeniably, cash is king and analysing cash flow is one of the key metrics when analysing a company’s financial performance. However, cash flow often misleads investors.

By definition, cash flow is the net income less taxes plus depreciation, depletion, amortization, and other noncash charges. This excludes capital expenditures, such as plant property and equipment (PPE), which should be considered as an expense, just like labour and utility costs. While maintenance of equipment is important, it does not help to grow the company. Unless you are willing to subtract all the necessary capital expenditures, Buffett cautions that you cannot focus on cash flow.

Instead, Buffett prefers to use “owner’s earnings”, which takes into account CAPEX.

Owner’s earnings = Net income + Depreciation, Amortization +/- Other noncash charges – CAPEX +/- Changes in working capital

(9) High Profit Margins

For Buffett, he knows that great businesses are lousy investments if the management is unable to convert sales into profits. He is strict on making sure that costs are kept low, with no unnecessary expenses to ensure high margins. Often, managers have to engage in restructuring program to keep costs down, in line with sales.

(10) One Dollar Test

For every dollar retained in the company, does it translate to at least one dollar in market value? This tells you if the company is able to invest capital at an optimal rate.

Key Learning Points: The financial tenets reveal the numbers required to determine the real value of the company. Using key metrics like ROE, profit margins, owner’s earnings and the $1 test.

Value

(11) What is the Value of a Business

To calculate the current value of a business, estimate the total earnings across the life of the business, then discount it backward to today. Note that Buffett uses owners’ earnings (net cash flow adjusted for capital expenditures).

Next, the question is what is the appropriate discount rate?

For Buffett, the discount rate would be the rate that would be considered risk-free. He considers the US long-term government bond because it is certain that the US government will pay its coupon over the next thirty years. This valuation method is known as the Discount Cash Flow (DCF) method.

(12) Purchase at a significant discount to its value

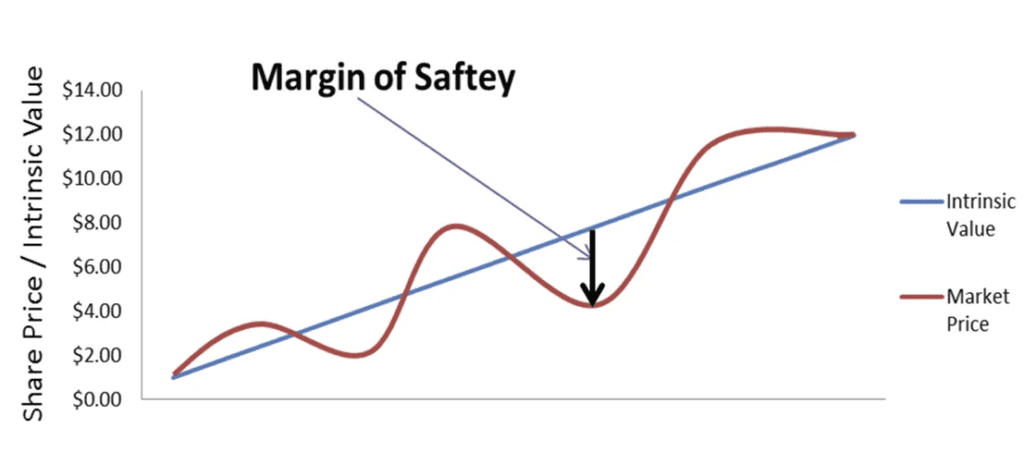

Is the price right? It is not enough just to identify good businesses. You have to also buy them at attractive prices, to ensure a sufficient margin of safety.

The difference between the price and intrinsic value represents the margin of safety.

Having a larger margin of safety protects investors from downside risk. It also generates more opportunities for outsized returns, as the stock price trends upwards to catch up with the intrinsic value of the business.

Key Learning Point: The value tenets allows you to do the math to come up with a decision if the company is a good buy and at what price. Two concepts covered include DCF and margin of safety.

On top of these 12 principles, the most important part of investing is this – to think and behave like a business owner.

Business Owner’s Mentality

When Buffett invests, he sees a business, not a stock price. Most investors spend far too much time and effort anticipating price changes. And they spend far too little time understanding the underlying business they are purchasing.

When you are purchasing a stock, you are essentially owning a slice of a company. Ask yourself “Is this a company which I would be happy to own?”.

Having this mindset of being the CEO of the company, will help you to think about the company’s decisions, and evaluate the business fundamentals from an owner’s perspective. After all, our job as investors is to try and determine what the business will look like in three to five years.

To be successful in investing, we need to take on the perspective as a business owner. Remember, you are buying a business, not just a stock.

Thank you for taking the time to read my blog.

Enjoying the content so far? I post articles relating to business, investing, personal finance and self-development.

If you are interested in any of these topics, do subscribe to stay updated of new posts.